In the face of a foreign investment deficit, Iran has observed its Arab neighbors inject capital into the northern territories, escalating trade activities. A notable development occurred on December 17 when the United Arab Emirates and the Republic of Azerbaijan inaugurated a joint investment fund worth $1 billion, managed equally by the Azerbaijan Investment Holding and the Abu Dhabi Investment Company. Investments are earmarked for clean energy, agriculture, pharmaceuticals, and technology, targeting Azerbaijan, the UAE, and Central Asia.

Members of the Gulf Cooperation Council (GCC), especially Saudi Arabia and the United Arab Emirates, have established investment agreements approaching $30 billion with Azerbaijan and Central Asian countries like Turkmenistan, Uzbekistan, Kazakhstan, and Kyrgyzstan. These pacts have fortified trade connections and emphasized non-oil commodities, with significant funding directed at clean energy projects.

Investments Transforming Azerbaijan’s Energy Landscape

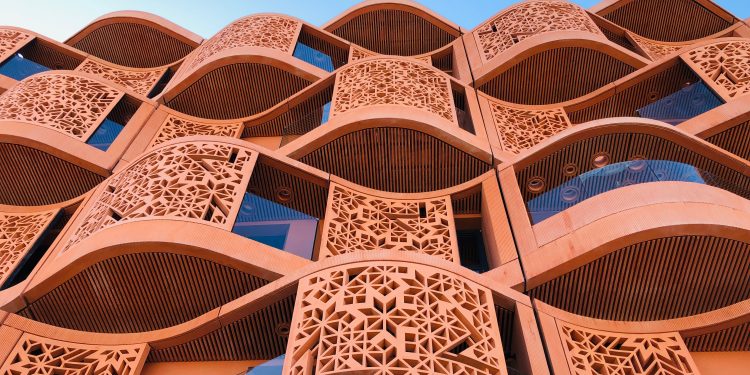

Two months prior, Masdar, an Emirates-based enterprise, revealed a $262 million solar plant in Azerbaijan, rated at 230 megawatts. Concurrently, agreements were signed to build three solar and wind power companies in Azerbaijan, with a total capacity of one gigawatt. French Total, British BP, and Saudi’s Acwa Power are investing $290 million to construct a 230-megawatt wind power station in the same region. These entities also cemented deals to produce 2,500 megawatts of wind and solar energy in partnership with Azerbaijan.

While Iran experiences energy shortages and an underdeveloped renewable energy sector, Azerbaijan’s collaboration with these energy companies includes vast electricity storage systems, enabling energy sale at premium prices during peak demand.

Azerbaijan has similarly optimized its natural gas trade by developing underground storage with a capacity of 3.5 billion cubic meters. The country stores surplus Turkmen gas in the summer to sell it during the winter at higher prices.

The Abu Dhabi National Oil Company (ADNOC) has also ventured into Azerbaijan’s energy market by acquiring a 30% share in the Absheron gas field in the Caspian Sea. With the first phase operational and the second phase aimed for 2027, the field is expected to supply six billion cubic meters of gas annually to European markets.

Baku aspires to double its natural gas exports to Europe within three years. Azerbaijan has initiated gas sales to its seventh European customer, Serbia, with total gas exports reaching 22 billion cubic meters in the first 11 months of the year.

Azerbaijan also plans to launch around 10,000 megawatts of renewable power plants by 2030, intending to export a significant electricity portion to Europe. An undersea cable project is set to facilitate Azerbaijan’s electricity export across the Black Sea to the Baltic region.

Trade between Azerbaijan and GCC countries has surged, with non-oil commodities making a substantial share of this increase.

Expanding GCC Footprint in Central Asia

The Gulf Cooperation Council’s broader engagement with Central Asia includes the UAE and Saudi Arabia, which have signed investment agreements exceeding $20 billion with the region. Qatar and Oman have also entered into new investment memoranda with these nations.

Armed with $4 trillion in investment funds and national wealth, GCC countries have launched innovative indigenous companies that integrate modern Western technologies, attracting foreign projects. The UAE’s Dragon Oil, for example, has exclusive rights to Turkmenistan’s offshore oil fields, with a new billion-dollar deal and $8 billion investment over 15 years.

The UAE has poured seven billion dollars into Kazakhstan and Uzbekistan, including solar and wind power projects. Qatar has established a joint investment fund with Kyrgyzstan, initially worth $100 million, with further commitments of $1.2 billion in projects.

The UAE also holds significant shares in Kazakhstan’s Khorgos Customs and Aktau Seaport. Saudi Arabia’s Acwa Power has inked contracts worth $13.5 billion with Kazakhstan and Uzbekistan for clean energy development.

In a meeting with GCC and Central Asian leaders, the Abu Dhabi National Energy Company announced a $3 billion investment in Uzbekistan, while Qatar pledged $12 billion in investments in the same nation. Oman and Kuwait are exploring new investments in the region, with Oman having a stake in Kazakhstan’s oil fields.

Iran’s Limited Engagement with Northern Neighbors

Iran’s economic interactions with its northern neighbors primarily consist of trade, conspicuously lacking joint investments and funds. Political tensions and international sanctions largely explain this situation.

Central Asia and the Caucasus account for a minor fraction of Iran’s foreign trade, despite cultural and historical ties. Iran’s trade with Central Asia, though growing, remains below 2% of its total foreign trade. The trade volume with countries like Kyrgyzstan and Tajikistan, and a 20% increase in trade with Kazakhstan, highlights the potential for growth.

Iran’s geopolitical stance in Central Asia is limited, overshadowed by the investments from GCC countries. To maintain influence in the region, Iran must recalibrate its strategy, easing tensions, particularly with Azerbaijan, and fostering conditions for better economic cooperation. Strengthening economic ties, leveraging cultural connections, and engaging in constructive dialogues will be crucial for Iran to sustain its regional significance amidst the changing geopolitical landscape.