Saudi Arabia’s Investment in Lucid Motors Faces Significant Drop in Value

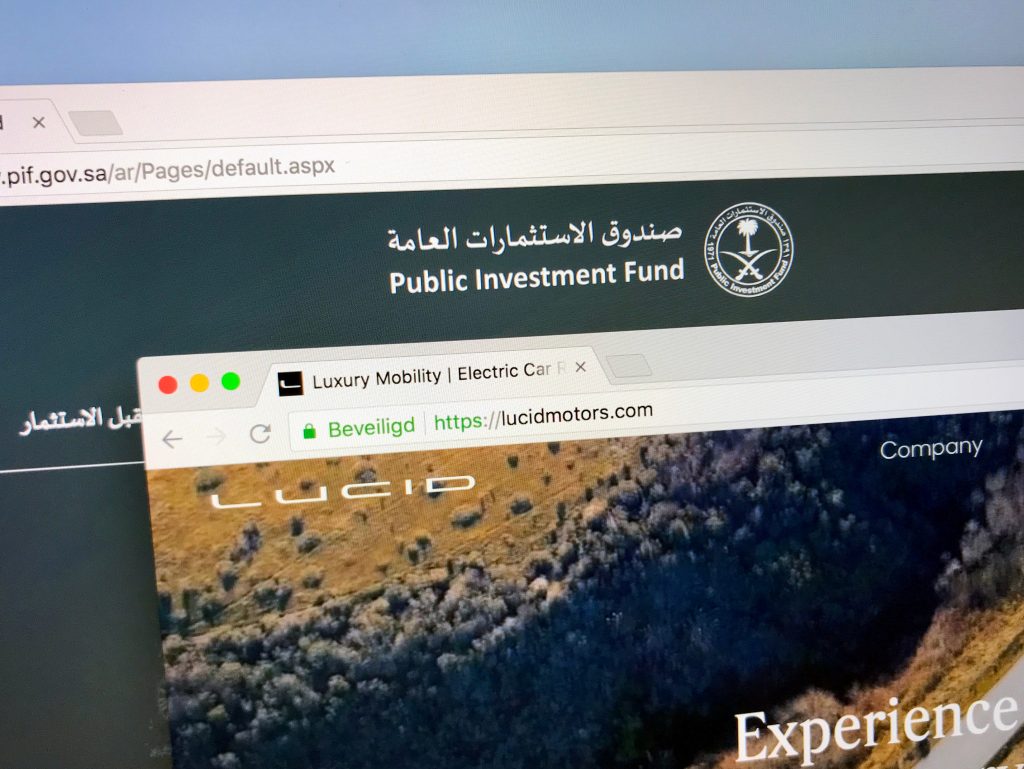

Saudi Arabia’s sovereign fund, Public Investment Fund (PIF), holds a 60% stake in Lucid Motors, an electric vehicle (EV) startup that is seen as a competitor to Tesla. However, this investment has yet to yield substantial returns for Saudi Arabia.

When Lucid Motors went public earlier this year, the 60% ownership stake held by PIF was valued at over $55 billion. However, according to a report by Bloomberg’s Chris Bryant, the value of this stake has now plummeted to $5.4 billion, a decrease of about 90%.

This sharp decline in value coincides with Lucid Motors’ latest quarterly earnings report. The company reported a net loss of $630.9 million and a gross margin of -207.74%, indicating that the cost of producing their luxury electric vehicles exceeds their sales.

Lucid Motors had previously reported a net loss of approximately $764 million in the previous quarter, suggesting that the company is losing $500,000 for every car it sells.

During an earnings call, Lucid’s CFO Sherry House defended the company’s financials, stating that the information regarding cash-burn-per-vehicle is “misleading and frankly misunderstood.” House highlighted various measures being taken to reduce costs and improve efficiency.

Despite the significant drop in stock value, Saudi Arabia has not incurred any losses on its investment. In 2018, PIF invested $1.3 billion in Lucid Motors, indicating the country’s substantial expectations for the EV company.

Saudi Arabia recently inaugurated its first car-manufacturing facility, capable of producing 5,000 electric vehicles annually, with plans to increase production to 155,000 vehicles in the future.

A spokesperson for Lucid Motors did not immediately respond to a request for comment.